Letting the Cash Flow

A special interview with Business and Finance teacher, Joey Running, regarding financial decisions and dealing with taxes.

In honor of the end of Financial Literacy and Tax month, Business and Finance Teacher, Joey Running shared some tips and resources for the student body to utilize, as well as, her perspective on the importance of being financially literate.

Some resources Running encourages students to utilize are TurboTax, Cash App, and the IRS website. There are many resources online regarding taxes and investing but it can be difficult finding a trustworthy source. If a student is looking to begin investing in the near future, investment companies like Vanguard, Fidelity, and Charles Schwab are great places to start. Often, students and adults alike hesitate to invest in stocks, bonds, or shares.

“In behavioral economics, what happens is we feel loss heavier than we feel our gains,” Running said. “So, even though we can earn money through compound interest — which is our superpower. So, when we lose our money…That’s a tremendous loss to us.”

It is important for our generation to be aware and comprehend the effect of the financial decisions we make because the advantages and benefits workers used to receive are starting to disappear. “In the past, we had traditional jobs where companies were responsible for retirement plans [and health plans, but] that’s not the case anymore.” Running said.

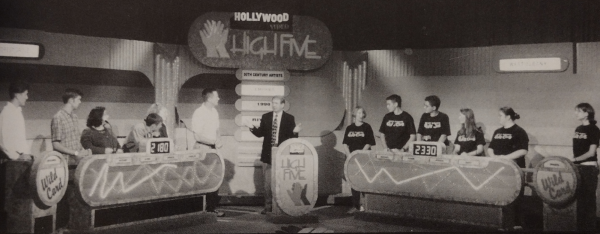

Therefore, with this motivation, Running, along with some students (sophomore Baylee Williams, junior Omar Moreno-Uribe, and senior Gabby Allen) and several other business teachers around the state, attended a conference to testify in front of the Senate Education Committee to advocate for making a financial course mandatory as a graduation credit. The act is still in the voting process so nothing has happened yet. “I’m crossing my fingers that there will be change,” Running said.

Some ways young adults can take advantage of their financial situation at the moment is by beginning to file their taxes. Many students and their guardians may not be aware that they are able to register as an independent when it comes to taking care of taxes. “And it’s not the case [of whether] they can [file], they should file them,” Running said.

By filing taxes on their own, a student receives the benefits of loan interest deductions, qualified tuition plans (529 plans), and even with their savings account. One of the biggest tips Running gives to students is taking at least 20% of their salary and placing it in retirement savings accounts to give them a headstart as they begin to enter a workforce that is gradually becoming more cutthroat when it comes to being able to retire.

“You are the person that is responsible for your retirement. You’re your future self.” Running said.

Your donation will support the student journalists of West Albany High School. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.

Avneet Dhaliwal has been on staff for more than a year and is now beginning her second as an Editor-in-Chief (EIC). Her area of specialization includes...