Financially Fit

How teaching students to be financially literate has helped prepare them for their future

The Dave Ramsey Plan states that the Five Foundations of Personal Finance are: Establish an emergency plan, pay off your debt, pay cash for your car, pay cash for college, and build wealth and give. But why is that important for students to know?

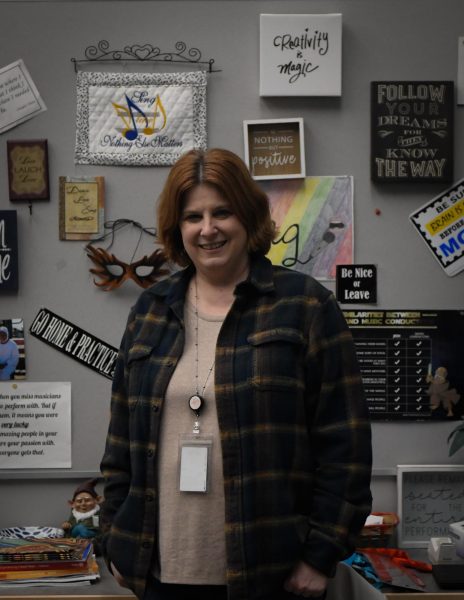

“Financial capability is being able to assess the money that you are bringing in, provide a spending or savings plan for that money, and be able to have a retirement plan in place when you get to that point,” said business teacher Joey Running. She currently teaches all four levels of Accounting, Personal Finance, Intro to Business, and Wealth Building and Management. Running said that being financially literate is extremely important nowadays because employers no longer provide a retirement layout, so now people need to know the background information on how to set that up.

Running teaches her students that a minimum of 20 percent of each paycheck should go directly into savings. She also verses students in the Ramsey plan, strongly recommending them to first set up an emergency plan if unexpected problems occur in life.

“It wasn’t a terribly hard class, but you had to really work and learn everything in that class because everything in there is things you use in your life,” said sophomore Chloe Wallace. Wallace is currently enrolled in Accounting I, and plans on taking most of the business classes in order to become an accountant. Wallace said finances are good to understand right now before college and before getting a job. One of the biggest reasons students take finance classes is because business, Running said, is one of the leading majors for graduating students.

Students are not required to take a personal finance class, but those that are currently enrolled in business classes highly recommend it. Statistics from Next Gen Personal Finance (NGPF) show that 69.3 percent of all U.S. high school students have access to at least one personal finance class as an elective. 51.6 percent in the state of Oregon, and the access to the class is growing as of July 2019, no longer leaving students to figure out finances for themselves. Running even hopes to begin an economics class next year, which will include the marriage of all classes that fall under the business and finance umbrella. But as an elective and not a required course, the results can often lead to a limited set of students allowed to take the course, or as the first few courses chopped during budget cuts.

“It wasn’t a terribly hard class, but you had to really work and learn everything.”

— SOPHOMORE Chloe Wallace

“Accounting is more for business stuff, but you see all the accounts and ‘Oh, this is where that goes’ […] so you’re not just like throwing money everywhere,” Junior Sarah Aufranc said. Aufranc considers pursuing a career in accounting, but even if she doesn’t, she said it’s still important to know about money because it’s what the world revolves around.

“I think the use of credit cards has become an easier way to spend money and people forget that credit cards are a loan, not their own personal money,” Running said. With credit cards, the money that one spends at the clothing or grocery store is not their personal money. It’s money from the bank, which must be paid back in a limited amount of time before interest has to be paid to said bank. Credit cards loan money from the bank, much like students get loans if they enroll in college.

“Pay your way through college, and don’t go through student loans because it’s just going to [hold you back],” Aufranc said. The potential debt that one can get into if they are not well versed in the system can lead to negative consequences on their personal finances.

“You will find yourself in situations where they just want you to sign on the dotted line and not having a good understanding of what that means… [It] could really get you in trouble,” Running said. By making good choices now and understanding how the student loan system works, a student can try to make their financial life as clear as it can be.

“Take Accounting and all the business classes you can,” Wallace said. “It really helps.”

Your donation will support the student journalists of West Albany High School. Your contribution will allow us to purchase equipment and cover our annual website hosting costs.